להלן קישור לכתבה המקורית

Summary

Worst political scenario unfolds nullifying the bull thesis.

New government goes U-turn on energy policy, heightens environmental regulations, scraps current projects under development.

KEPCO profits are shrinking, and the company is likely to continue to underperform.

Without a transparentdividend distribution policy, I’m avoiding the stock.

In March last year, I decided to cover Kepco (KEP) with my article “The market is wrong about Kepco.” The company receives very little coverage, and the piece became a viewership success (it was also an Editor’s Pick): it is to-date my most read article on Seeking Alpha. Ironically, Kepco turned out to be the worst-performing stock I ever recommended on the site so far too.

The investment thesis

An energy monopoly in its home country South Korea, last year I argued that this SOE was trading at undeserved low multiples. The company was showing a multi-year margin expansion and excellent profitability levels, relatively stable leadership under CEO Hwan Eik Cho and willingness to harvest further opportunities in the nuclear space abroad following the Westinghouse bankruptcy. KEP stock had just been through a market sell-off because of governance uncertainties, but with the political situation on its way back to normalization, I judged the company a buy.

Time to eat humble pie

Yes, South Korea was undoubtedly emerging from months of political instability. The rallies held in the capital Seoul, which saw millions taking to the streets (something unseen in the country before) were over. Former President Park was impeached and removed, and elections set for the upcoming May.

While the governance doubts were cleared, the election’s outcome was not a favorable one for Kepco shareholders. In my bullish view, while I correctly identified the threats KEP was facing, I failed to assess their real impact on Kepco. I was neither right nor wrong because the crowd disagreed with me: I was wrong because facts proved the contrarian approach to be wrong in this case. Here is why:

New President tightens regulations, shies away from coal and nuclear

The part of the story I got right is that Korea’s political developments mattered a lot for Kepco. In fact, the single most important red flag for KEP shareholders was the election of President Moon Jae-In, a Democrat, last May. His win was to be expected entirely considering that conservatives were in total disarray after Park’s impeachment.

With the traditionally strong conservative party split between “loyalists” and “antagonists” of the former President, none of which having much public favor, right-wingers’ bets were all on rising star Ahn Cheol Soo. However, its independent party failed to pose a credible threat to Moon despite receiving favorable press.

I perceived Democrats’ ideas on energy policy as somehow vague during Moon’s electoral campaign and ended up not paying too much attention until it was too late. Moon did not take long to translate his vague thoughts into actions. In early June, it was already possible to see what kind of troubles were lying ahead for Kepco: with Reuters providing an interesting article on the subject for the international public. The new President quickly reshaped Korea’s energy policy to focus on reducing carbon emissions and stabilizing Koreans’ energy bills, at the expense of KEP cost-effectiveness and profits.

CEOs resign

While last year I argued Kepco found stability under CEO Hwan Eik Cho, the argument was close to meaningless since the CEO was however set to depart soon. Indeed, his 5-years as CEO were already an unusually long span, considering that the standard mandate is a 3-year non-renewable tenure. After having been granted with two one-year extensions by President Park’s cabinet, it was fair to assume Cho’s retirement would not have been delayed further by the new government, despite the impressive turnaround in Kepco’s operating results.

Cho’s departure became official last December, closely followed by the abrupt and unexpected resignation of Lee Kwan-Seop, head of Kepco’s subsidiary Korea Hydro & Nuclear Power Co. (KHNP). His departure has been widely connected to the anti-nuclear stance taken by the new administration. The yet to be announced replacements will have to navigate Kepco and KHNP through rising fuel costs, expectations that no price hikes will be passed on to consumers till 2022 and the new government's desires to see renewable sources increase their power generation share from the current 5% to at least 20% by 2030.

Kepco’s operating margins are sinking (again)

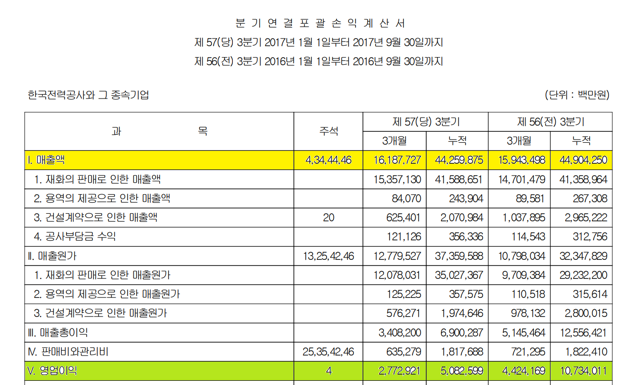

While FY 2017 results are not yet available, I looked at the most recent Q3 results (in Korean). Unfortunately, I did not find anything in English to link, but I will explain relevant data:

Excerpt of Kepco Q3 Income statement from the company website (link).

Nine-month revenues were flat compared to the previous year (yellow line) and slightly up in the last quarter, but EBIT (green line) was down 37% in the third quarter and down 53% for the nine months (!!!).

Why all this matters now?

I once have been accused to have written an article with just “a lot of hindsight.” Regardless of whether I deserved the objection, one thing is for sure: successful investing is not about knowing all the details about a stock’s history, but rather to correctly predict what will happen to the business in the future. Unfortunately, the past is often a tricky way to assess the future. However, I believe the information just provided about Kepco was meaningful, not only because it materially affected the stock’s price in the recent past, but because it is also likely to influence the company’s operating performance for years to come.

Considering elections are now due in 2022, the current strategy will materially affect Kepco for nearly a decade (unless we see another “U-Turn” after the next round). The headwinds mentioned above are not one-off: Kepco is likely all set for a new prolonged phase of business underperformance. Kepco, being a utility that operates in a regulated market, is a traditional playground for two types of investors: bargain hunters looking at fundamentals and income investors. And now, the company seems just to be a bad investment for both of them.

Kepco’s dividends: cut or scrapped?

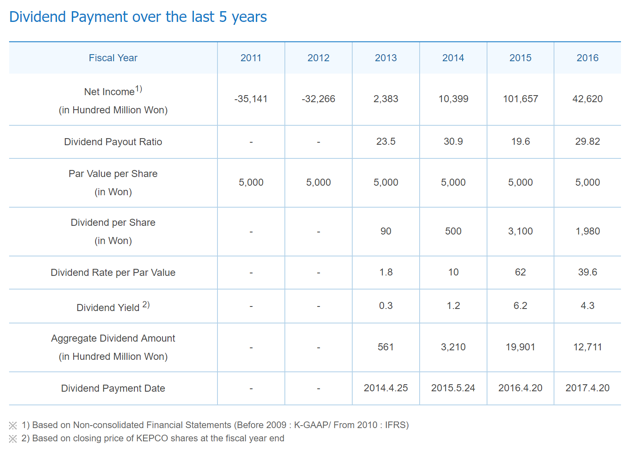

While Kepco has been paying an annual dividend since 2013, the company has never set an official amount to distribute to shareholders nor a target payout ratio. As a result, the distribution ranged from a paltry amount of 90 KRW per share in 2014, a yield of 0.25% at the current share price to 3100 KRW (8.7% yield) in 2016. The dividend is traditionally declared at the end of the year, but my take on the issue is that 2018 distribution will be announced later as the CEO is still vacant.

In fact, 2017 dividend declaration was delayed as well pending Cho’s tenure extension, but then the record date was retroactively set on December 31st. Traditionally, Kepco has paid a dividend for about 20%-30% of its net income, and I think the company will do the same in April 2018. However, shareholders should not expect a high yield from Kepco.

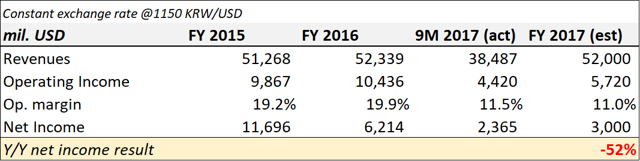

Based on the company’s nine months performance, here are my expectations for the FY 2017:

Rising fuel costs, a 3 months suspension on coal plants operation imposed in the early stages of Moon’s government, a moderate rate reduction to end users and here we have the perfect storm: operating and net income cut in half of what they used to be in FY 2016. Barring an unexpected hike in payout ratio (or a steeper cut), Kepco will possibly continue to pay dividends for about 30% of its net income.

Kepco’s 2018 distribution might be around 900 KRW/share ($0.4 for the ADR) or a 2.5% yield considering the current price of about $16. If long-term income investors, the usual type of shareholders owning utilities, are left without a reliable dividend distribution policy to rely on, then there is no reason to hold on Kepco shares instead of a steady payer like Dominion Energy (D).

Kepco’s dividend information from the company website, yet to provide an update for FY2017 (link).

Kepco’s cheap valuation

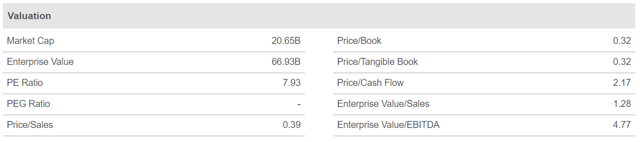

Data source: Seeking Alpha

The other potential Kepco shareholders are the value guys, those who are always looking for bargains and are naturally attracted by low multiples (no offense intended, I am also one of them). Indeed, Kepco seems to be trading at low multiples (look above and see for yourself) but judging a cyclical business using peak earnings (and cash flows) is usually a terrible idea.

Investors may find out that not only the stock is not as cheap as the current EV/EBITDA number misleadingly suggests: both previously used as comparable French EDF (OTCPK:ECIFY) and German RWE (OTCPK:RWEOY) also currently trade for an EV/EBITDA below 5x according to website Gurufocus.

If Kepco's EBITDA deteriorates further, fundamentals would even justify a further slide in price. The P/BV is undoubtedly low, but the value is neither unseen nor unjustified since utilities like Kepco have been traditionally long-term underperformers and loss-makers. Even if the asset valuation is potentially attractive, the grim business prospects point at a classic “value trap” case where bargain hunters contemplate a perennially cheap stock with no catalysts. All in all, there is just no reason to believe Kepco’s low multiples are unjustified or undeserved.

A final note. I decided not to include a stock chart in this article because, for fundamental investors, it is just a source of cognitive bias. Past does not equal future, and even if Kepco shares have lost a little more than 20% since my unfortunate recommendation last March (and are now off more than 40% from their 2016 high), it does not imply the current price is a bargain.

Personally, I decided to take a loss last year in the tax-selling window and move on. As I see it, Kepco turned to be a very sour fruit with the new government pushing hard on environmental issues and keep households’ costs low. To score easy points, Moon’s administration will likely forego Kepco profits for a long while, and therefore my current recommendation is to AVOID the stock.

Don't miss the next breaking dividend investing idea! Seeking Alpha's premium research subscribers get early access to top dividend investing ideas?

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.